Insurance%Investment

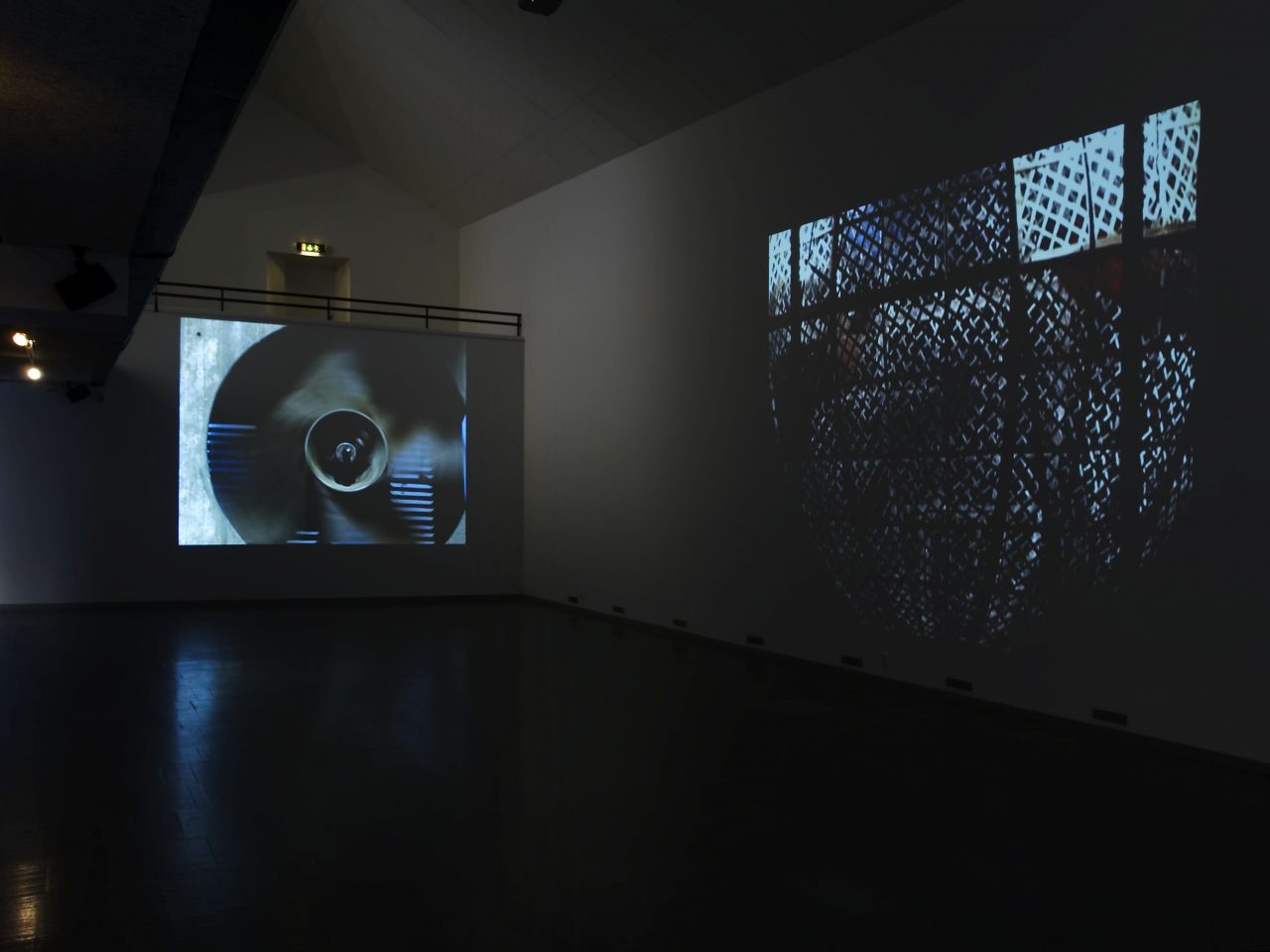

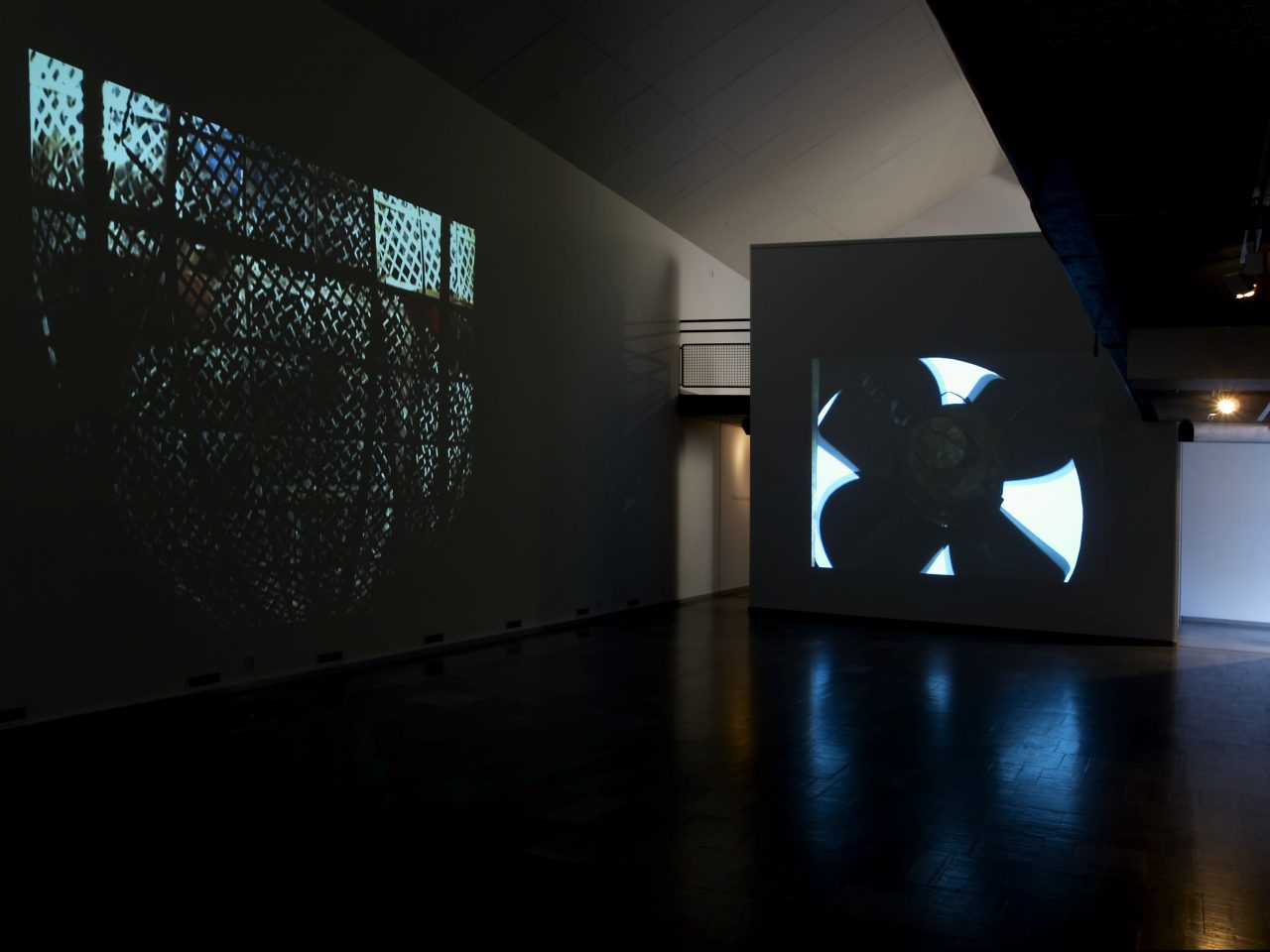

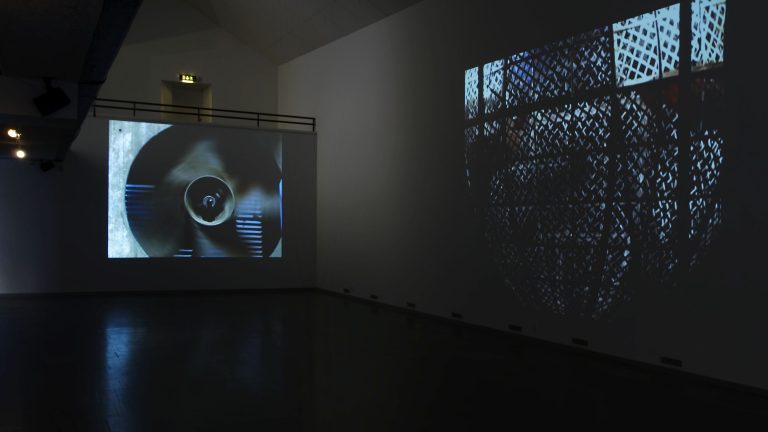

Shown at: Art of the Possible, Lunds Konsthall, Lund (2007)

Three videos with sound tracks, wallpaper with photographic prints

Insurance%Investment illustrates the mental arithmetic of investment and insurance, two mechanisms designed to administer, anticipate and forestall risk, speculation and the possibility of failure. Whirling motorcyclists in a fairground ‘well of death’, giant rotating fan blades, oxygen masks, empty rooms with ornate wall paper and a soundtrack that suggests the respiration of strange machines constitute a constellation of uncanny effects that poise the visitor in a space full of riveting ambivalences.

The proliferation of cautionary motifs only emphasizes the latency of danger. Everything is anticipated, yet anything is possible.

Every articulation of possibility is also a tacit admission of risk. In imagining that something is likely to happen we often elide the fact that the very idea of ‘likelihood’ contains within it an understanding of failure. When we say that the odds of a venture succeeding are even, we imply that the chances of success are fifty percent or that it is just as likely not to succeed. Every solicitation for investment in the future comes annotated with the fine print of the likelihood of disasters.

The relationship between likelihood and the unattainable, between possibility and failure, between hope and the premonition of danger is essentially a ratio, a percentage. The mental operations we perform on the basis of our understanding of the idea of percentage are the triggers that catalyse most of our crucial decisions with regard to the future. We are forever calculating the odds, performing the mental arithmetic of hope and despair. Capitalism expresses possibilities in the language of investment. At the same time it administers our attempts to deal with the idea of risk through the rhetoric of insurance. Successful investments generate the climate that makes it possible to generate extraordinary amounts of wealth in record duration. This requires a speeding up and intensification of production, an uprooting of obstacles and the rapid and radical transformation of societies and environments, usually accompanied by tremendous violence and disruption. The higher the investments, the greater the damage to extant patterns of life.

Buy a stock option, get a disaster free.

This is where insurance comes in. You can be insured against every damage to your life and environment caused by the forces unleashed by investments. Insurance and investment come calling hand in hand. Insurance and investment share a common vocabulary of premiums and returns, though geared towards diametrically opposite ends. When you invest in something, you are hoping that your bet on the likelihood of the success of a venture will be borne out by the future. When you insure against something, you are attempting to protect yourself against the likelihood of things going wrong. You may in fact be insuring yourself against the likelihood of bad investments, as much as attempting to garner some security for yourself and your dependents in the event of being discarded from a productive life. Insurance companies are able to promise the returns that they do, because they invest the money that people make available to them. Investment options lay claim to the dream of making your future work for you, insurers lay claim to looking after you in the event of your future going wrong.

Insurers invest. Investors insure.